Built to Protect. Driven to Win. Powered by a Proven Path.

APC Valuation Process

You’ve spent years building something valuable, something meaningful.

Now you’re considering your next chapter, and the stakes couldn’t be higher.

Guidance You Can Trust

Know what you’re worth, know what’s next.

At APC, we walk with business owners through a proven valuation process that provides more than insight. It delivers confidence, direction, and peace of mind.

You’ll Get:

- A quick initial assessment to determine your valuation baseline

- An initial analysis on your financials and performance data

- A 185-page MVA™ report, digitally and/or in print

- A shareholder presentation for you and your team

Step 1: VAC™ – Value Acceleration Calculator

Uncover the core drivers that determine your company’s value and where to focus for the greatest impact.

Step 2: MVA™ – Market Value Assessment

Our proprietary MVA™ report offers unmatched insight for owners who want a realistic, strategic view of their business’s value in today’s market.

Inside the MVA™ Report

Know your market value, build a strategy to grow it, and move forward with confidence.

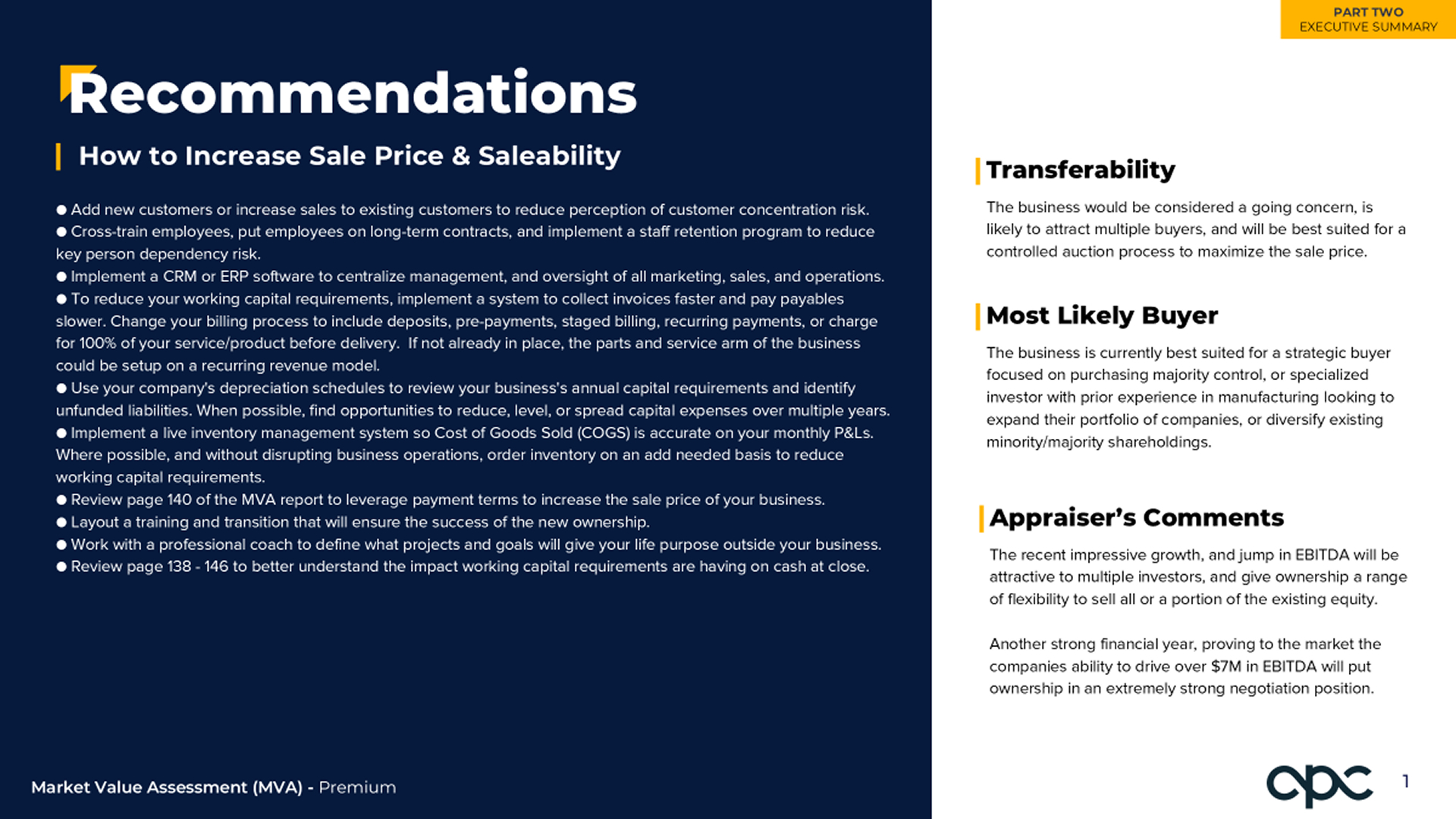

Part 1–2: Executive Summary

Key takeaways on market value, risk profile, industry multiples, and high-level recommendations.

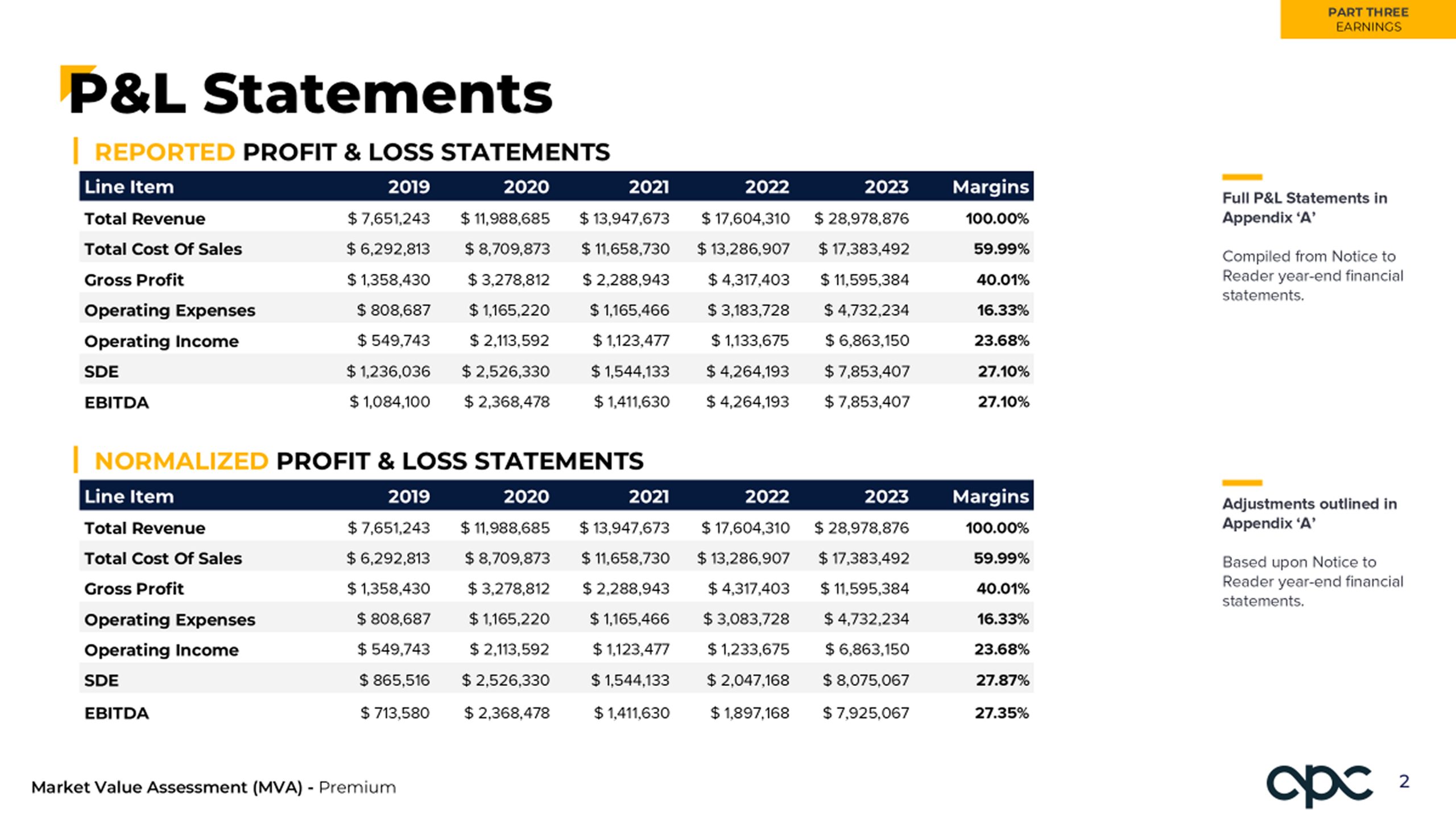

Part 3: Earnings

Normalized financials that show your company’s true earning power and the numbers buyers really want to see.

Part 4: Risk

Identifies where perceived risk lies and how it impacts valuation. Reducing risk increases value—often more than increasing returns.

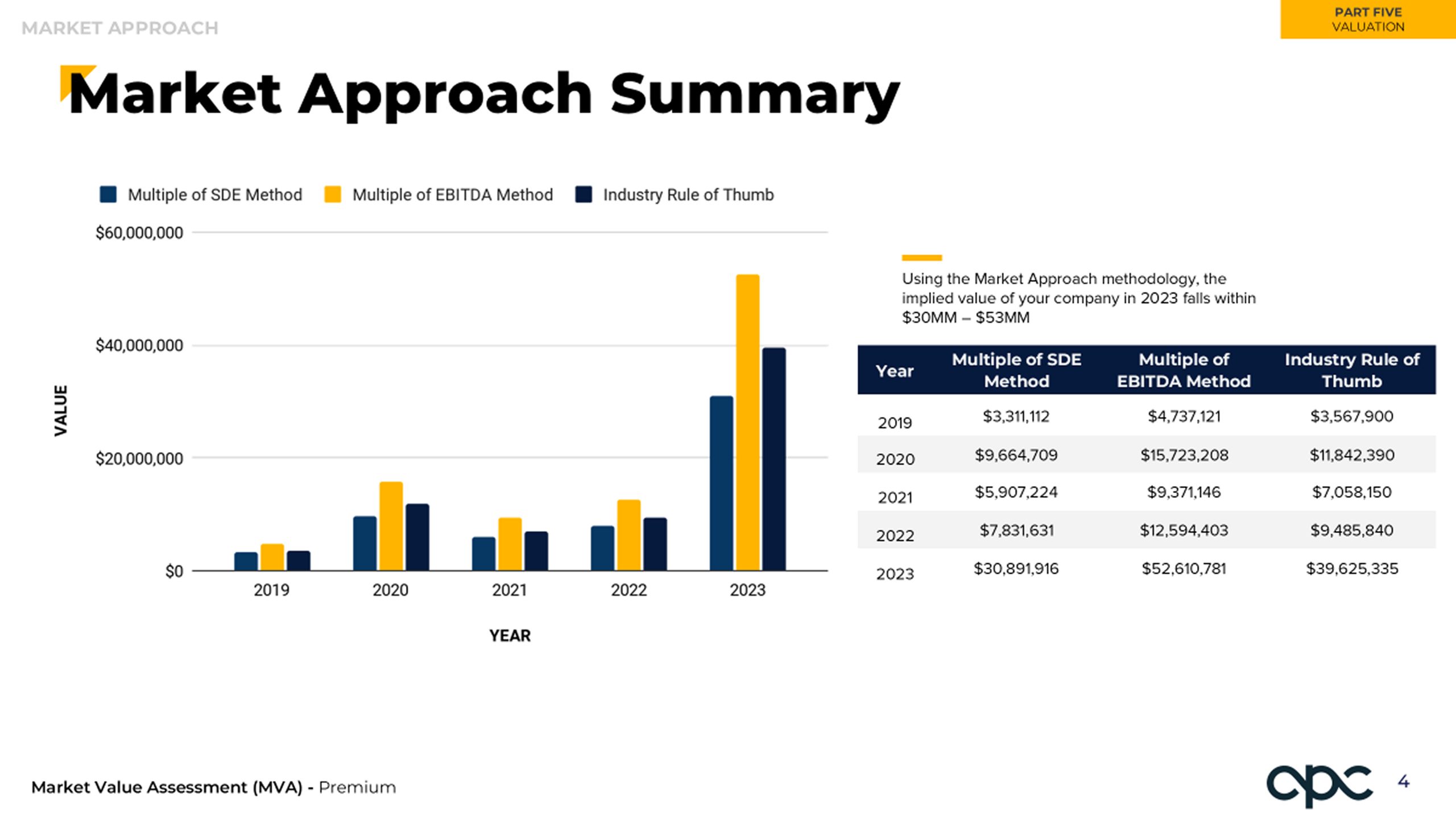

Part 5: Valuation Methodologies

A comprehensive comparison across 11 valuation models to determine the most accurate market-based value.

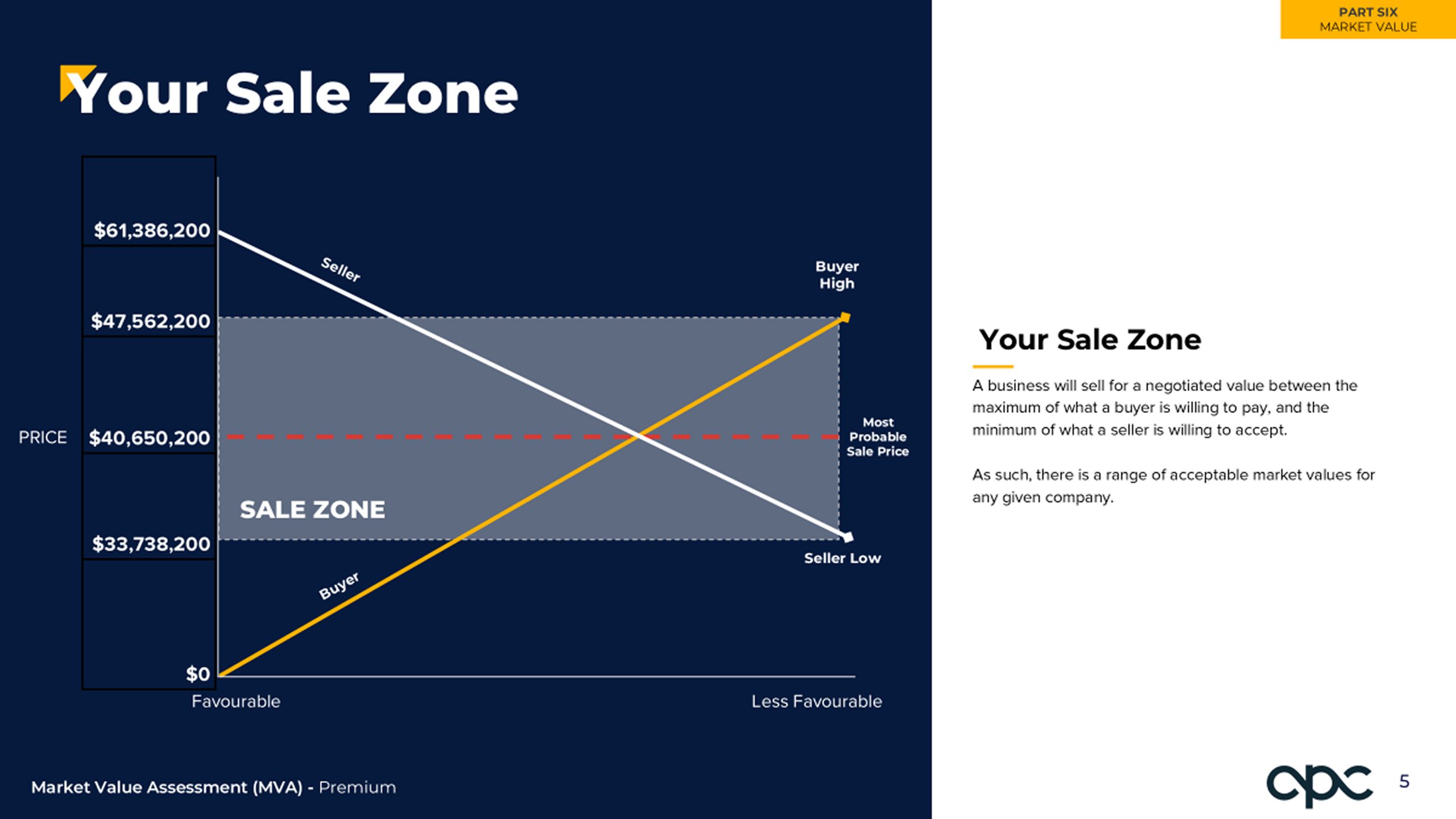

Part 6: Market Value Range

Estimates what qualified buyers would actually pay, based on industry data, financial health, and buyer demand.

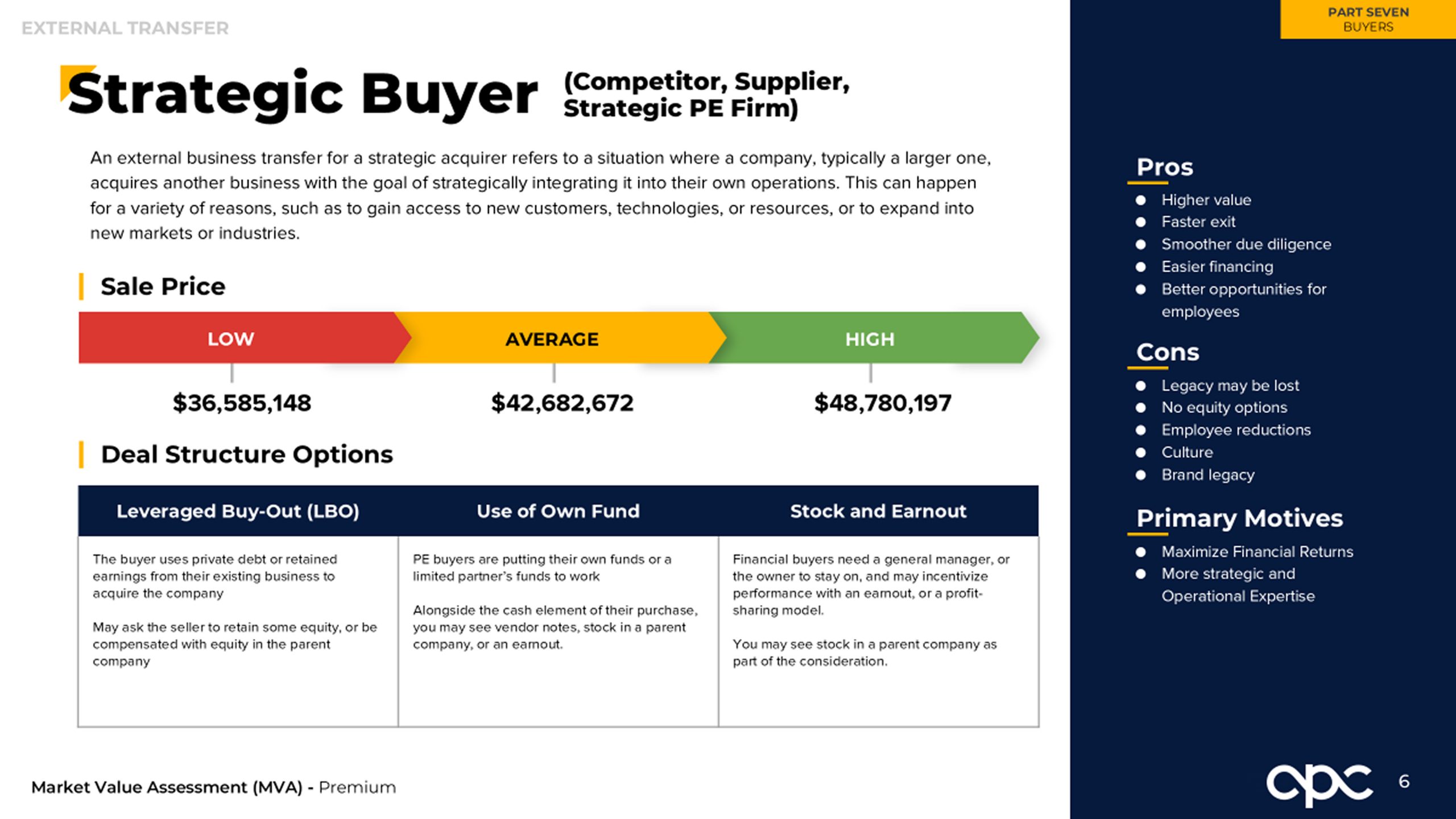

Part 7: Buyer Insights

A detailed breakdown of 12 buyer types and what they value, how they pay, and what they avoid.

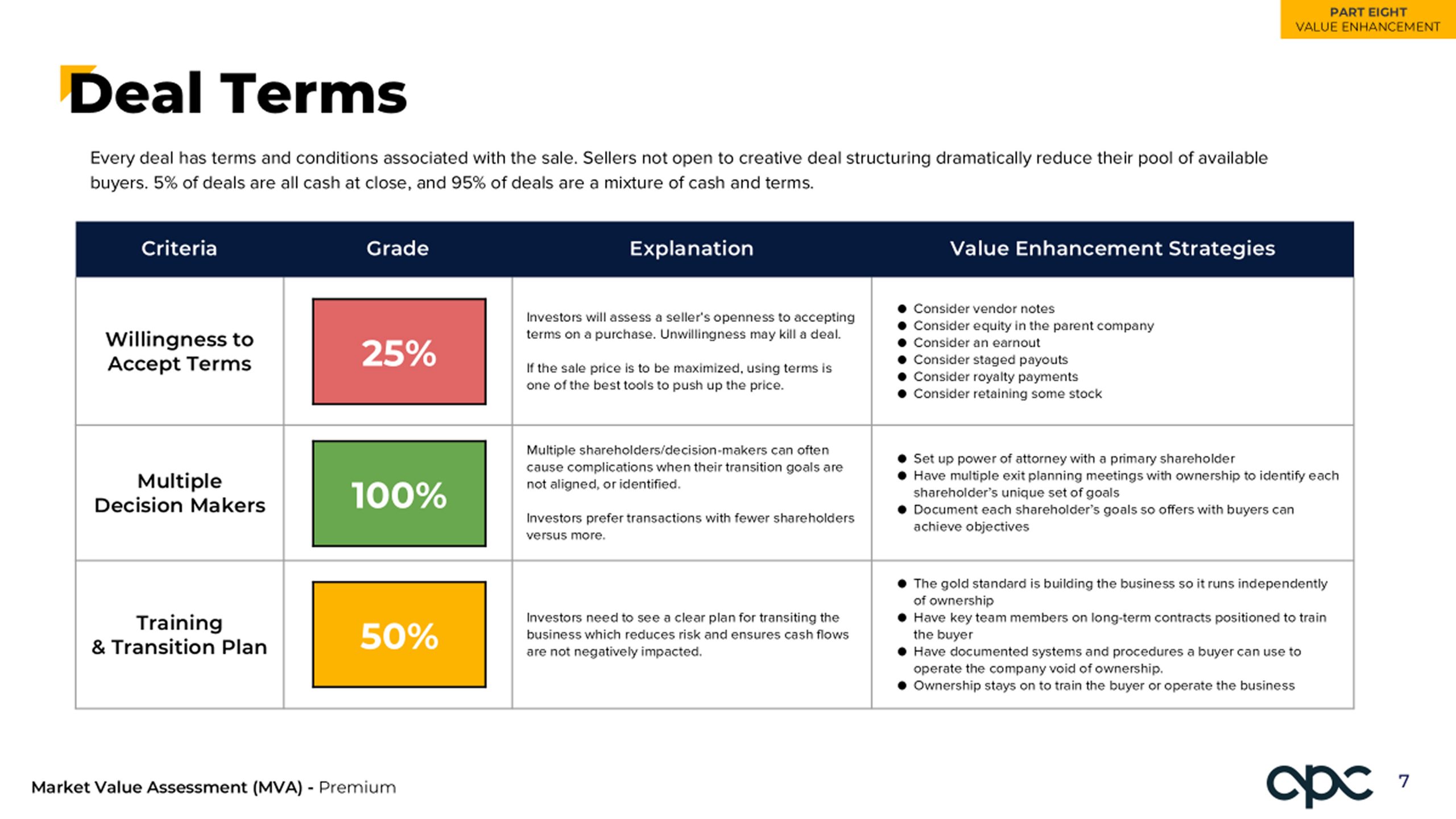

Part 8: Value Enhancement

Targeted recommendations for reducing risk and increasing value across operations, leadership, financials, and more.

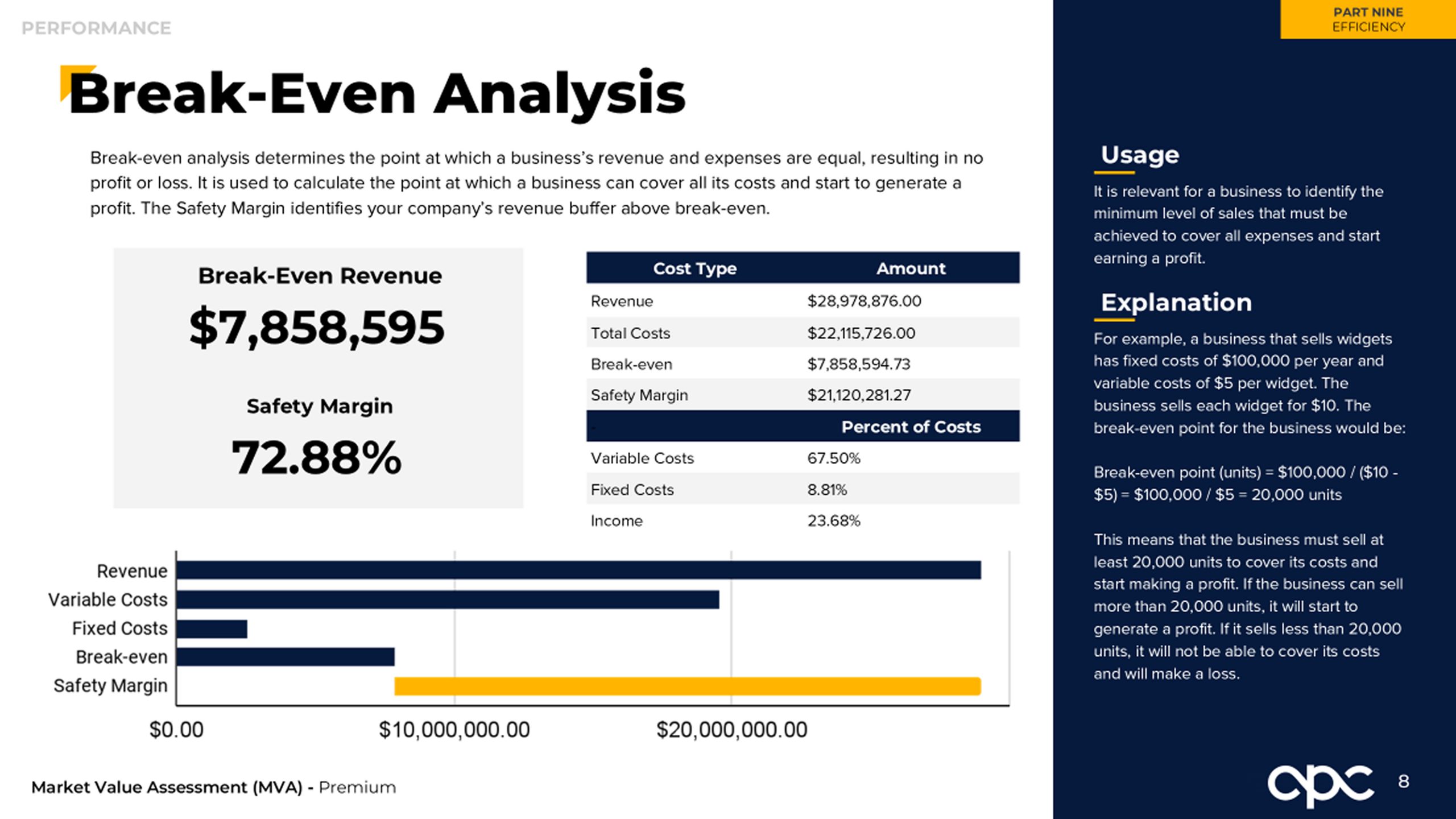

Part 9: Operational Efficiency

Benchmarking and ratio analysis using 20+ key performance indicators to evaluate your efficiency and growth potential.

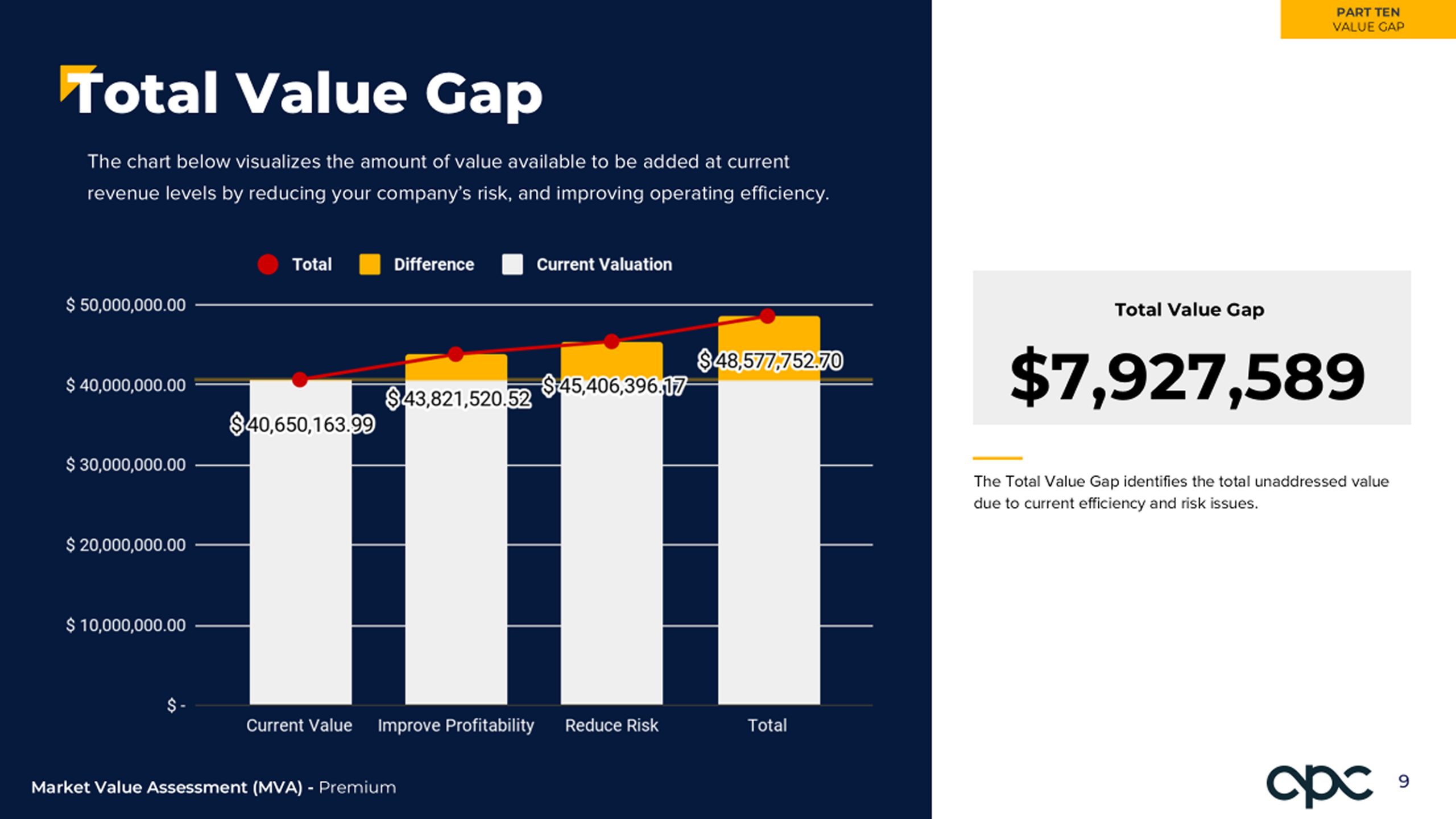

Part 10: Value Gap

Using the findings in Part 9, this section shows the difference between your current valuation, your full potential, what’s on the table, and what’s being left behind.

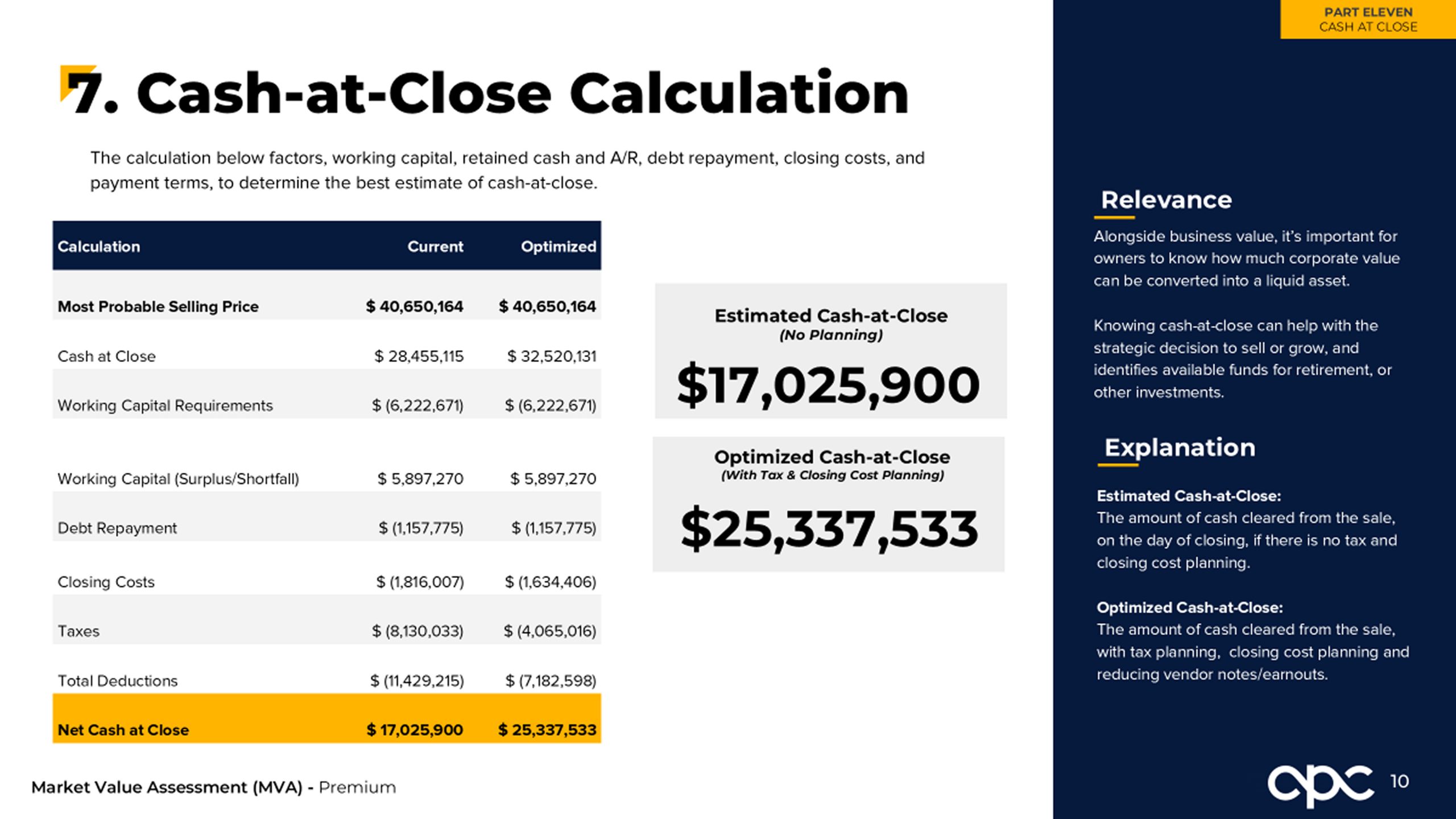

Part 11: Cash at Close

A detailed projection of how much cash shareholders will receive after transaction costs, debt repayment and taxes.

MVA™ Use Cases

Key takeaways on market value, risk profile, industry multiples, and high-level recommendations.

- Value Enhancement Strategy

- Exit Planning / Sale Preparation

- Shareholder Buyouts or Buy-Ins

- Partner or Management Transitions

- Generational Transfer

- Attracting Investment or Financing

- Divorce / Estate / Tax Planning

- Evaluating Unsolicited Offers

Your value revealed. Your strategy unlocked.

It All Starts With One Step

Call Us